Fighting Information Asymmetry - Or How To Buy a Used Car

Here is the official friso.lol guide to buying a used car. Enjoy!

For The Netherlands, there is an excellent aggregator site for used car classifieds: www.gaspedaal.nl (the domain name literally translates to to gas pedal, i.e. the accelerator in a car). It will tell you that there are just north of 430 thousand individual used cars available on the Dutch market across 1293 unique models. Which one of those is a good enough deal for you?

Let us start with the obvious: you have some preferences of your own. The following criteria apply:

- road legal

- five doors

- station car

- gasoline (i.e. no diesel, electric, hybrid, etc.)

- manual transmission

- fits within a purchase budget range of 8,500.- — 10,000.- EUR

We don't care about anything else. We are looking for a means of transportation, not a lifestyle product. If you like nice cars anyway, you should aspire to be rich enough to collect; owning just one is always a compromise.

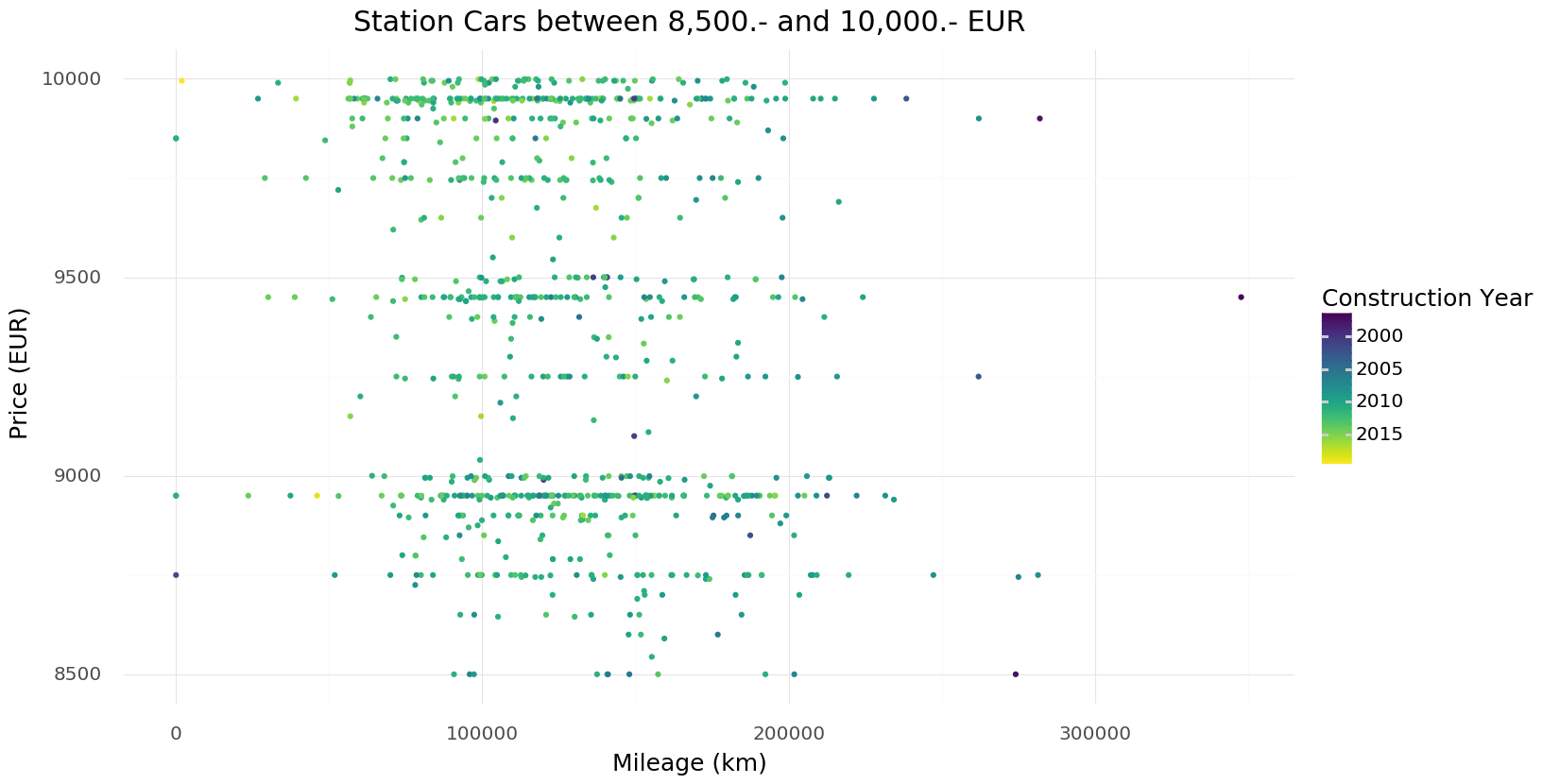

With the above criteria, out of the 430 thousand cars and 1293 unique models, only 1083 cars across 69 models remain. Not bad, but still a lot of models to choose from. In order to make buying easier for us, we will only consider models of which at least 25 are available on our budget. This leaves us with 859 cars across 17 unique models. You can see them here:

From this plot we learn that a) there are cars available across our budget range and b) quite literally your mileage may vary, at any price point. We observe no relation between mileage, construction year, and price. This is unfortunate reality highlights that not all cars are created equal. We need to select one or a few models to focus our attention on.

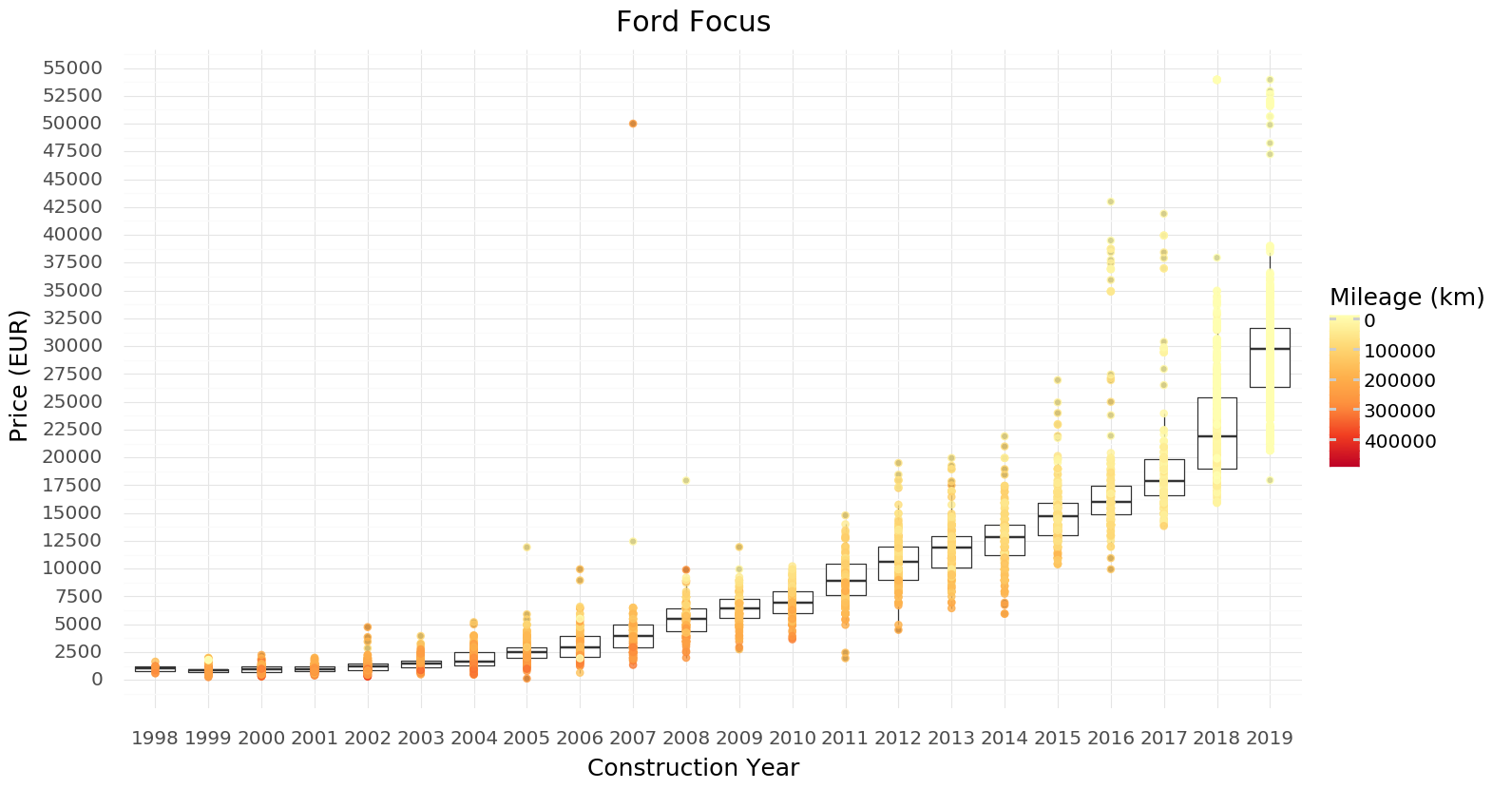

Picking some arbitrary car model, we can have a better look at the relation between mileage, construction year and price. (Note that the plot below does away with our budget constraint, but it still only concerns manual transmission gasoline cars.)

We see a nice relation between the price and construction year (age) of the car. And given a construction year, the mileage is a good indication of the car's worth. The same plot for other models shows similar characteristics.

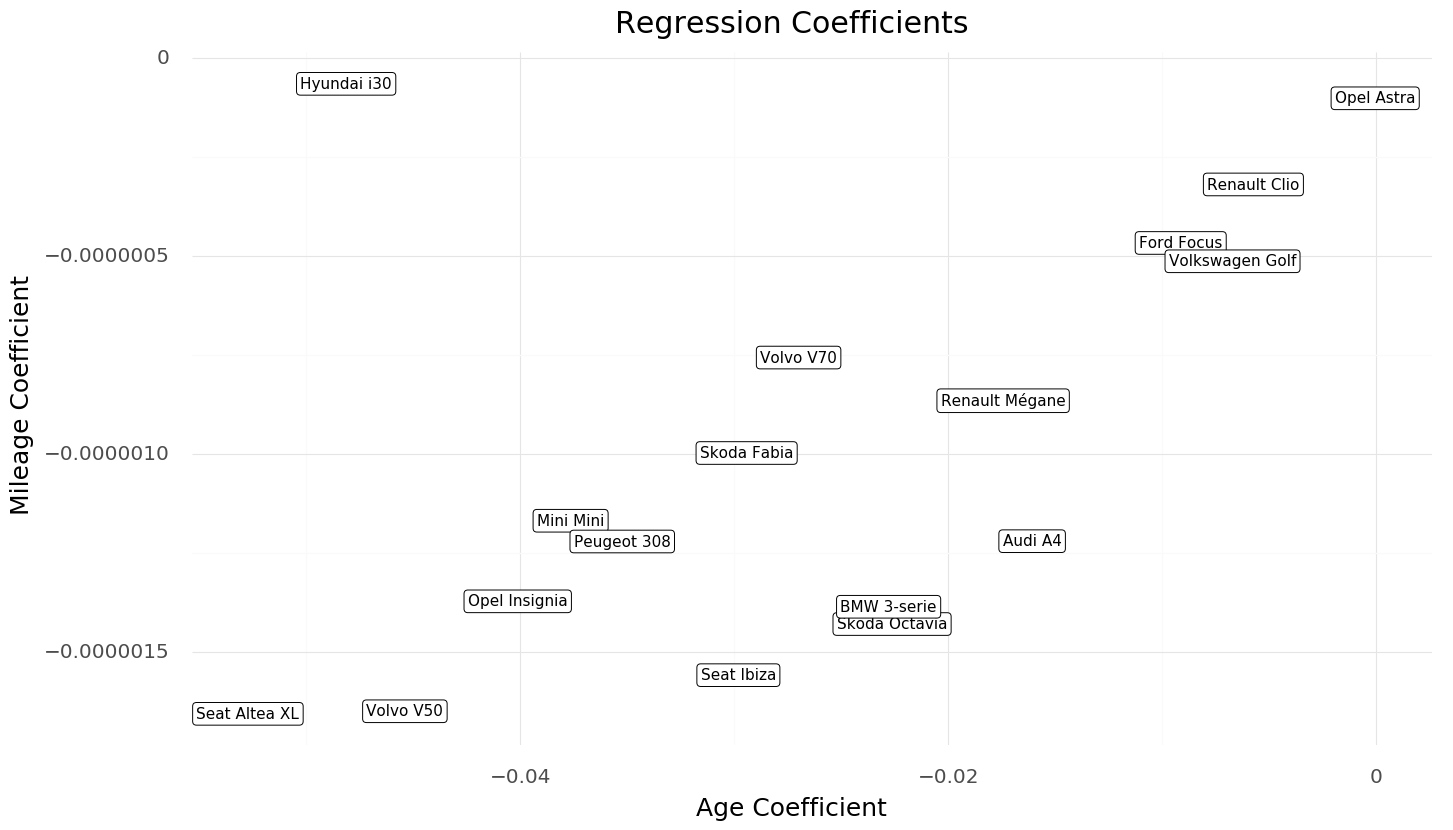

Next we come to a car model selection by making some very presumptuous assumptions about how things work and bluntly fit a linear regression to model the normalised price for a particular vehicle given its age and mileage. We assume that the mileage coefficient of the regression correlates inversely with life expectancy. Price is normalised, because we don't care how expensive a car was originally, just how much relative value it loses per kilometer driven compensating for age.

Better domain knowledge would likely yield more nuanced assumptions and we should compensate for the obvious issue that price and mileage are confounded by age, but buying a car is quite the opposite of fun and we just want to get it over with. No time for nitpicking.

Car models on top are expected to retain value longer and cars on the right either lose value with age or are typically seeing a lot of mileage in their regular use (remember the lurking variable). We decide not to care about the latter and use the former as a selection criteria: the top 5 cars from top to bottom make up our short list. From these, pick one based on personal preference. We will choose the Ford Focus, because I at least know what it looks like so I can relate.

From above, you can see that the median price for a 2011 Ford Focus is the youngest that fits our budget. The median mileage for a 2011 Ford Focus turns out to be 124,249 kilometers. Here is how you buy your car:

- Research which specific issues to look for when test driving a Ford Focus. About thirty minutes of reading DIY car maintenance forums will do. Create a list of questions that are specifically important to the chosen car model. Things like: "when were the rear breaks last replaced?" or "do you know if this car was used to pull a caravan?".

- Find about five or six 2011 Ford Focus for sale with a mileage close to the median, that are available close to where you live. Asking price doesn't matter.

- Make appointments to test drive all five of them in one weekend.

- After test driving one, fire of your list of questions. If there is nothing obviously wrong at this point, ask the sales person if he can offer you the car for 5% under the median. If he says "yes", tell him you'll let him know by Monday; if not, thank him for his time and walk away. If the sales person suggests some alternative car or model, tell them "No thanks" and walk away.

- On Monday, call the sales person who had the best of the five cars and tell him you are prepared to buy it at 5% under the median.

- Congratulations on your purchase!

(At this point, many will object that our strategy doesn't compensate for maintenance cost resulting in high or low Total Cost of Ownership. Your car is a risk bearing asset, with the ultimate downside potential of losing it entirely; it can go up in flames, can be declared total loss after a accident, can be stolen, and in extreme cases can be deprived of utility by local policy — thank you city of Amsterdam. When this maximum draw down materialises, you lose whatever amount you have invested up to that point, minus the marginal amount that you possibly recover from insurance. If you buy a 10k car and lose it after a week you lose 10k. If you buy a 20k car with the idea that it will be cheaper than the 10k car after five years of use, you stand to lose 20k as well as immediately miss out on whatever return you could have made on investing the 10k difference. The fact that losing your entire car is a low probability event is interesting when you buy 10, 100, or 1000 cars. Not one. You can get this confirmed by anyone who has ever had their car stolen.)

You Don't Know Anything About Cars

Of course I don't. That's entirely the point. Chances are you don't know anything about real estate, yet bought a house. Most people don't know anything about salary distributions, yet expose themselves to salary negotiations. Did you ever blindly move to a new job through a recruitment agency? These are all examples of advisors who thrive on information asymmetry.

With our strategy, we did two very specific things:

- Quickly acquire a useful information position in relation to the used car market: the median asking price for a Ford Focus. This levels the playing field and improves your assessment.

- Narrow the scope of the conversation to one very specific item about which we can realistically learn enough to withstand sales / advisory bullshit: our list of questions about a used Ford Focus. This greatly reduces the sales person's leverage from his superior information position. It no longer matters he knows more about all other car models.

This applies in many situations. If you ask a mortgage broker to finance your home, they will provide a solution at minimal effort and make up some story about why this is sound advice. If you ask mortgage brokers to finance your home utilising a specific form of mortgage, with a hard constraint on the interest rate, and a number of non negiotable terms and conditions that the provider must apply, they will either tell you to go away or they will put some effort into making it work. If it proves too hard they will then tell you to go away. You are looking for the ones who will make the effort; they are likely not seasoned mortgage brokers and still have something to prove. They may even believe that providing you a tailored service is part of the job…

The Age of Information

Does that used car classifieds aggregator site make all those plots and provide those numbers? Of course not. That's entirely the other point.

Used car sales people know how much they paid for the car, unlike you. Mortgage brokers have a single system that exposes all mortgage possibilities to them, unlike you. Real estate brokers share a single system where they can easily obtain local insight into the housing market, unlike you. Recruitment professionals know the entirety of their database of prospective candidates and employers, unlike you. Hiring managers know the salary distribution and the budget for the role they are hiring for, unlike you. That is the essence of asymmetry and that is their unfair advantage. To fight this, you need to be less you and more real estate specialist, used car pricing expert, or recruitment consultant. You need to level the information asymmetry the best you can.

You have one unfair advantage though: you can code and you understand the internet. You wrote about 100 lines of Python code to scrape some websites, create some plots, do some filtering, and bam! you are the used car pricing expert at the next family birthday party.

It is probably good to understand that anyone graduating from higher education after today, will have had some exposure to computer programming or scripting if they studied anything other than literary criticism. And anyone graduating five to ten years from now will have had the same exposure in high school. It's never too late to start coding yourself if you are not doing so now. Of course I am not sure how this helps used car salesmen…

As a contemporary digital native, there is literally no excuse to enter any conversation that can meaningfully impact some aspect of your life or business, without minimally obtaining a just in time upgrade of your information position on the topic. Hack your way to some useful statistics. Then narrow it down to one small part where you need a sliver of actual domain knowledge and read up.

Unless you are talking to the doctor. Doctor knows best.

In Conclusion: Is There No Good Advice?

When you make a very specific and informed request, seasoned advisors will tell you they are willing to do that for you, but warn you that you are not necessarily acting in your own best interest. Then there are two possible lines of reasoning: 1) they will provide some anecdotal evidence of how your request was a bad move for some other people or 2) they will concisely explain to you how you are not optimising for your underlying goals by introducing a piece of information that you had not taken into account. Option 1 is trying to scare you into their path of least effort. Option 2 is what advisory should be about. You can direct the advice by sharpening their view of your goals and subsequently, the advisor uses their superior information position to help you optimise for those goals.

A mortgage advisor typically asks you how much you earn, but instead you should be able to ask them "how much do I need to earn and what does that depend on?". Given your context and constraints the best advice may not be a mortgage but a suggestion to look for another home instead. Useful advisory starts by fully drawing out context, goals, and constraints before any advice is given.

Everything else is disguised sales and inherently misaligned with your incentives. You can't avoid it in life, but you can considerably level the information asymmetry because information is more generally available then ever before. If only you know how to make structure of semi- and unstructured online resources. That's a good skill to have and use.